Toyota Motor announced this week its plans to embrace a groundbreaking technology pioneered by Tesla called “Gigacasting.” This move is part of Toyota’s strategy to enhance the performance and reduce the cost of future electric vehicles (EVs). Toyota is not the only automaker following Tesla’s lead in adopting this innovation. Let’s take a closer look at Gigacasting and how it is compelling automakers to strive to match Tesla.

Gigacasting refers to the utilization of the Giga Press, an aluminum die-casting machine that Tesla has implemented in its factories across the United States, China, and Germany. These colossal machines have the capability to manufacture aluminum parts significantly larger than any previously used in the automotive industry. The term “giga” in Gigacasting is an homage to Tesla’s practice of naming its facilities “Gigafactories.” Other automakers have also referred to them as “megapresses,” which can encompass smaller but still sizeable machines.

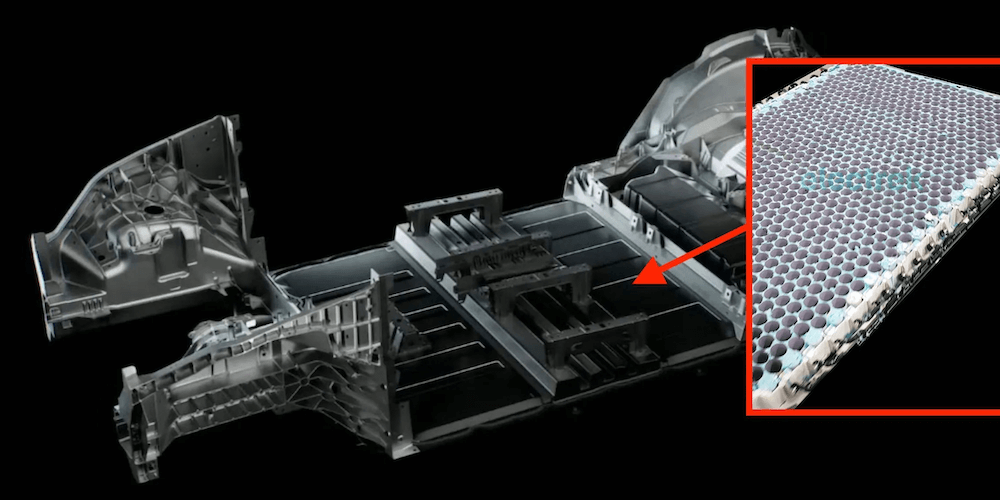

The functioning of the press involves injecting molten aluminum weighing 80 kg (176 lb) or more into a mold, where it takes shape as a part, is then released, and rapidly cooled. Tesla has also developed a unique aluminum alloy that eliminates the need for the traditional heat treatment process used to enhance the strength of cast parts.

What are the advantages of Gigacasting? Traditionally, manufacturing a car body required welding together over a hundred individually stamped metal parts. Analysts have attributed Tesla’s industry-leading profitability to the reduction in parts, lower costs, and simplified production line achieved through Gigacasting. For instance, by using a single component in the rear of their best-selling model, the Model Y, Tesla managed to cut related costs by 40%. Elon Musk has also mentioned that by incorporating a single piece from the front and rear of the Model 3, they were able to remove 600 robots from the assembly process. Moreover, Gigacasting can reduce the weight of vehicles, which is particularly important for EVs where the battery pack alone can weigh over 700 kg. Additionally, it holds the potential to minimize waste and greenhouse emissions in manufacturing plants.

The manufacturers of these machines include Italy-based IDRA, which supplies presses to Tesla and has been a subsidiary of China’s LK Industries since 2008. Other competitors in the market include Buhler Group in Europe, Ube and Shibaura Machine in Japan, as well as Yizumi and Haitian in China. According to an analysis by AlixPartners, the global aluminum die-casting market was valued at nearly $73 billion last year and is projected to exceed $126 billion by 2032.

Various automakers are pursuing Gigacasting technology. Apart from Toyota, General Motors, Hyundai Motor, and affiliates of China’s Geely, including Volvo Cars, Polestar, and Zeekr, are either implementing or planning to utilize this technology. Zeekr, for example, has already begun using massive aluminum die casts for a multi-purpose van sold in China and intends to introduce the technology to other models. Volvo announced a $900 million investment last year to upgrade its plant near Gothenburg, Sweden, with megapress technology.

However, there are challenges associated with adopting Gigacasting. One significant obstacle is cost. Tesla’s sales primarily revolve around just two models: the Model 3 and Model Y. The high sales volume of these two platforms makes it easier to justify investing in new production technology. Other electric vehicle startups also benefit from this advantage. Legacy automakers with more complex product lineups and amortized factory machinery find it more challenging to decide whether to invest tens of millions of dollars in new casting technology, as analysts have pointed out. Furthermore, cars with body sections cast as single pieces could potentially be more difficult or costly to repair.