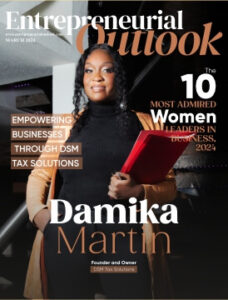

Damika Martin: Empowering Businesses Through DSM Tax Solutions

The 10 Most Admired Women Leaders in Business, 2024

Damika Martin, the Founder and Owner of DSM Tax Solutions, stands as a beacon of entrepreneurial spirit and collaborative prowess. Her journey as the proud proprietor of a small finance and tax service firm took an unexpected turn when her admiration for music artist Dej Loaf led to a remarkable partnership with the talented artist CheekyChizzy.

DSM Tax Solutions, under Damika’s leadership, specializes in serving self-employed individuals, businesses, and W2 employees. The company provides assistance to individuals across various industries, ensuring that they receive support whenever they need an extra hand. Recognizing that business owners and freelance professionals are often immersed in the daily operations of their ventures, Damika’s firm takes on the responsibility of handling crucial aspects like taxes.

DSM Tax Solutions offers a comprehensive range of tax planning and preparation services, catering to the unique needs of businesses and individuals. Committed to empowering its community, the firm equips individuals and businesses with the tools they need to take control of their financial matters.

Damika’s journey exemplifies the impact that small finance and tax service firms can have on businesses and individuals. Through DSM Tax Solutions, she continues to contribute to the success and financial well-being of her clients, fostering a collaborative and empowering environment for all.

Self-Discovery in Finance

Damika’s journey into the world of finance began around 10 years ago when she started delving into her own financial matters, including credit scores and tax-related activities. Through this process, she discovered her passion for finance. Drawing from her observations of financial professionals and small business owners in the field, Damika noticed a trend of overpricing for such services.

Driven by her love for the community and newly found passion for finance, Damika decided to take matters into her own hands. She aspired to create a budget-friendly tax services business, aiming to serve individuals regardless of their financial status—whether they were less fortunate or more affluent. This reflects Damika’s commitment to making financial services accessible to a wider audience and addressing potential disparities in the pricing of such crucial services.

Tech Proficiency

Damika highlights three significant milestones that presented considerable challenges and growth opportunities:

- Advancing Knowledge of Technology: This milestone reflects Damika’s commitment to staying current and proficient in technology. In today’s fast-paced digital landscape, having a good understanding of technology is crucial, especially in fields like finance and tax services. Damika likely faced the challenge of adapting to new technologies and tools, showcasing her dedication to professional development.

- Learning to Communicate Better with Different People Over the Globe: Effective communication is a valuable skill, and Damika recognized its importance in dealing with a diverse audience spanning different regions. This milestone suggests that Damika actively worked on enhancing her communication skills to connect with people from various backgrounds and cultures. This ability is particularly essential in a globalized world.

- Advertising: Advertisement is acknowledged as both the hardest and most expensive of the three milestones. Damika emphasizes the challenges associated with advertising, including the financial investment required. The cost range mentioned (from $2,500 to $7,000) underscores the significant resources involved. Despite the difficulty and expense, Damika persevered in advertising to promote her business. This commitment to marketing and outreach demonstrates resilience and a focus on community impact.

Damika’s determination and resilience shine through in her commitment to pushing forward for her community, even during times when it may have seemed that their efforts were going unnoticed. This unwavering dedication is a testament to her passion for serving the community, irrespective of external recognition.

From Curiosity to Action

Damika’s journey into the tax services business started with a genuine concern for her community and a realization about the pricing practices of her original tax preparer. Here are the key points:

- Interest in Taxes: Damika has always had an interest in taxes, which likely stems from her curiosity about financial matters. This interest laid the foundation for her eventual entry into the tax services industry.

- Referring People to Tax Preparer: Initially, Damika referred people in her community to a tax preparer. This indicates a willingness to help others with their tax-related needs and a desire to connect people with professional services.

- Realization of Overcharging: Damika discovered that the tax preparer she was referring people to was overcharging her clients. This realization likely sparked a sense of responsibility and an opportunity for Damika to make a positive impact by offering a more affordable alternative.

- Taking Matters Into Own Hands: Empowered by the understanding that she could provide tax services at a fair rate, Damika decided to take matters into her own hands. This demonstrates her proactive approach to addressing an issue within her community.

- Charging a Fair Rate: Damika’s decision to charge a fair rate reflects her commitment to making tax services accessible and affordable for her community. This customer-centric approach aligns with her goal of creating a budget tax services business for individuals, regardless of their financial status.

Damika’s journey showcases a combination of community engagement, ethical considerations, and a proactive response to challenges. By recognizing an issue and offering a solution, Damika has contributed to making tax services more equitable and affordable for those she serves.

Empathy in Action

Damika envisions DSM Tax Solutions as a community-oriented business with a strong commitment to the betterment of society. The principles and morals of the business are centered around benefiting the local community. The overarching goal is to make the community a better place by addressing challenges, improving living conditions, and fostering unity. DSM Tax Solutions aims to ease the struggles of those facing challenges, providing support and resources. The business strives to contribute to a safer and more educated community, emphasizing long-term positive outcomes. Damika also expresses an interest in merging with music, showcasing a creative approach to community engagement. Additionally, DSM Tax Solutions has a global advertising goal, reflecting an ambition to impact communities beyond the local sphere and create positive change on a broader scale.

Cultivating Peace of Mind

At DSM Tax Solutions, Damika prioritizes maintaining peace of mind and incorporates meditation practices to guide the team. The focus is on creating a comfortable environment where everyone, regardless of background, can participate in a sophisticated business. Partnerships with other financial companies are established, and support for other businesses is a key aspect. The vision includes helping other businesses grow through professional business techniques.

Empowering Finances

Damika takes a moment to educate individuals with different needs and circumstances about various aspects of taxes. She provides information on potential write-offs and expenses that they may be eligible to claim but might not be aware of. This educational approach aims to empower individuals to make informed decisions about their finances and optimize their tax-related benefits.

Changing Lives

DSM Tax Solutions is currently involved in a project for a group home for troubled children, primarily based in Arizona. The goal is to expand these group homes across the USA and potentially globally. DSM Tax Solutions collaborates with both big and small companies, aiming to provide assistance in any way possible.

Global Vision

Damika envisions the future of DSM Tax Solutions as a global entity that extends its assistance to various communities beyond her own. The goal is to contribute to financial success, facilitate credit building, and simplify the process of purchasing homes. The vision is to become a business accessible to individuals of any economic class, providing support for their financial needs. Constant communication with clients is a priority, aiming to create a comfortable environment where clients feel free to share concerns, provide feedback, or seek advice.